Mobile Home Insurance

We’re Phoenix’s Leaders in Mobile Home Insurance Coverage

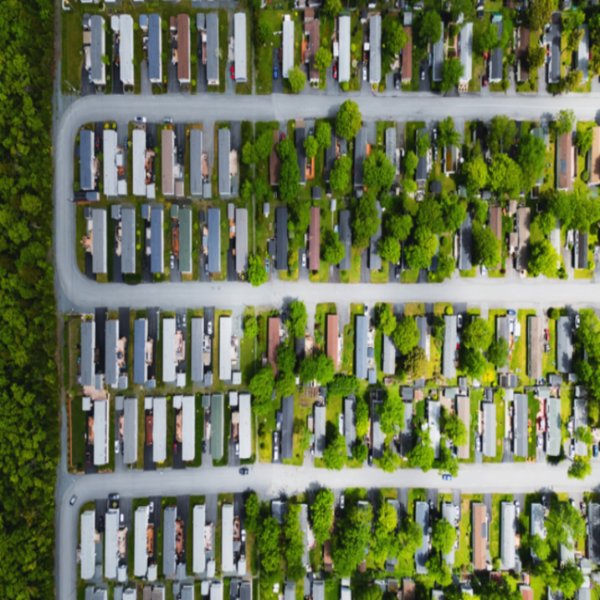

Living in a mobile home offers flexibility and affordability, especially in the Greater Phoenix Area. Nevertheless, mobile homes need protection from unexpected events just like their traditional counterparts. Ideal Insurance offers mobile home insurance in Phoenix and the surrounding communities. Having the right insurance plan will give you peace of mind when facing storm damage, theft, or liability issues. Keep reading to learn what mobile home insurance is, why you need it, and how to find affordable options.

What Is Mobile Home Insurance?

Mobile home insurance, otherwise known as manufactured home insurance, protects your home and belongings from damage or loss. It works similarly to traditional homeowners’ insurance but is tailored to the needs of mobile and manufactured homes. These policies typically cover:

- Damage to your home’s structure

- Personal belongings inside your home

- Liability if someone gets injured on your property

- Additional living expenses if your home becomes unlivable

Since mobile homes are built differently from traditional houses, they require specialized coverage. Standard homeowners’ insurance won’t provide the protection you need.

Why You May Need Manufactured Home Insurance in Arizona

Many mobile homeowners wonder if insurance is truly necessary. Here’s why it’s essential:

- Protection from Natural Disasters – Arizona experiences monsoons, dust storms, and high winds. These weather events can cause significant damage to mobile homes. Insurance helps cover repair costs so that you’re not stuck paying out of pocket.

- Lender Requirements – If you have a loan on your mobile home, your lender will likely require you to have insurance. This protects their investment and ensures you can rebuild if disaster strikes.

- Liability Coverage – Accidents happen. If a visitor is injured on your property, you may be held responsible for their medical bills and legal fees. Liability coverage helps protect your finances.

- Peace of Mind – Knowing your home is protected lets you focus on enjoying life instead of worrying about what could go wrong.

What Mobile Home Insurance Plans Cover

Understanding your options will help you choose the best mobile home insurance for your needs. The main types of coverage include:

- Dwelling Coverage – This covers structural damage caused by covered events like fire, wind, hail, or vandalism.

- Personal Property Coverage – Your furniture, electronics, clothing, and other belongings are protected against theft and damage.

- Liability Protection – If someone is injured on your property or you accidentally damage someone else’s property, liability coverage will help pay for legal and medical costs.

- Additional Living Expenses – If your home becomes uninhabitable due to a covered event, this coverage pays for temporary housing, meals, and other necessary expenses while repairs are being made.

- Optional Add-Ons – You can customize your policy with additional options like flood insurance, earthquake coverage, and replacement cost coverage.

How to Get Affordable Mobile Home Insurance

Finding affordable mobile home insurance doesn’t mean sacrificing coverage. You can save money while staying protected if you:

- Compare Mobile Home Insurance Quotes – Shopping around is the best way to find competitive rates. Ideal Insurance makes it easy to compare quotes.

- Bundle Your Policies – Combine your mobile home insurance with auto or life insurance to qualify for discounts.

- Increase Your Deductible – Choosing a higher deductible lowers your monthly premium. Just ensure you can afford the deductible if you need to file a claim.

- Improve Home Safety – Installing smoke detectors, security systems, and storm shutters can reduce your insurance costs.

- Maintain Good Credit – Insurance companies often use credit scores to determine rates. Keeping your credit in good standing can help you qualify for lower premiums.

Mobile Home Insurance Coverage Benefits

Investing in manufactured home insurance offers several advantages:

- Financial Protection – Repairs and replacements can be expensive. Insurance covers these costs so that you don’t have to drain your savings.

- Legal Protection – Liability coverage protects you from lawsuits if someone gets hurt on your property.

- Flexibility – You can customize your mobile home insurance plan to fit your specific needs and budget.

- Local Expertise – Working with a Phoenix-based agency like Ideal Insurance means you’ll get advice from experts who understand Arizona’s unique risks.

Rely on Us for the Best Mobile Home Insurance in Phoenix

Ideal Insurance has more than four decades of experience serving the Greater Phoenix Area. More importantly, we’ll take the time to understand your needs and find a coverage policy that fits your lifestyle. Our team will deliver exceptional customer service and ensure you receive the protection you deserve.

Contact Our Mobile Home Insurance Agents Today

Don’t leave your mobile home unprotected. Ideal Insurance can guide you through the process and help you find affordable mobile home insurance that gives you peace of mind. Contact us today to request a mobile home insurance quote.